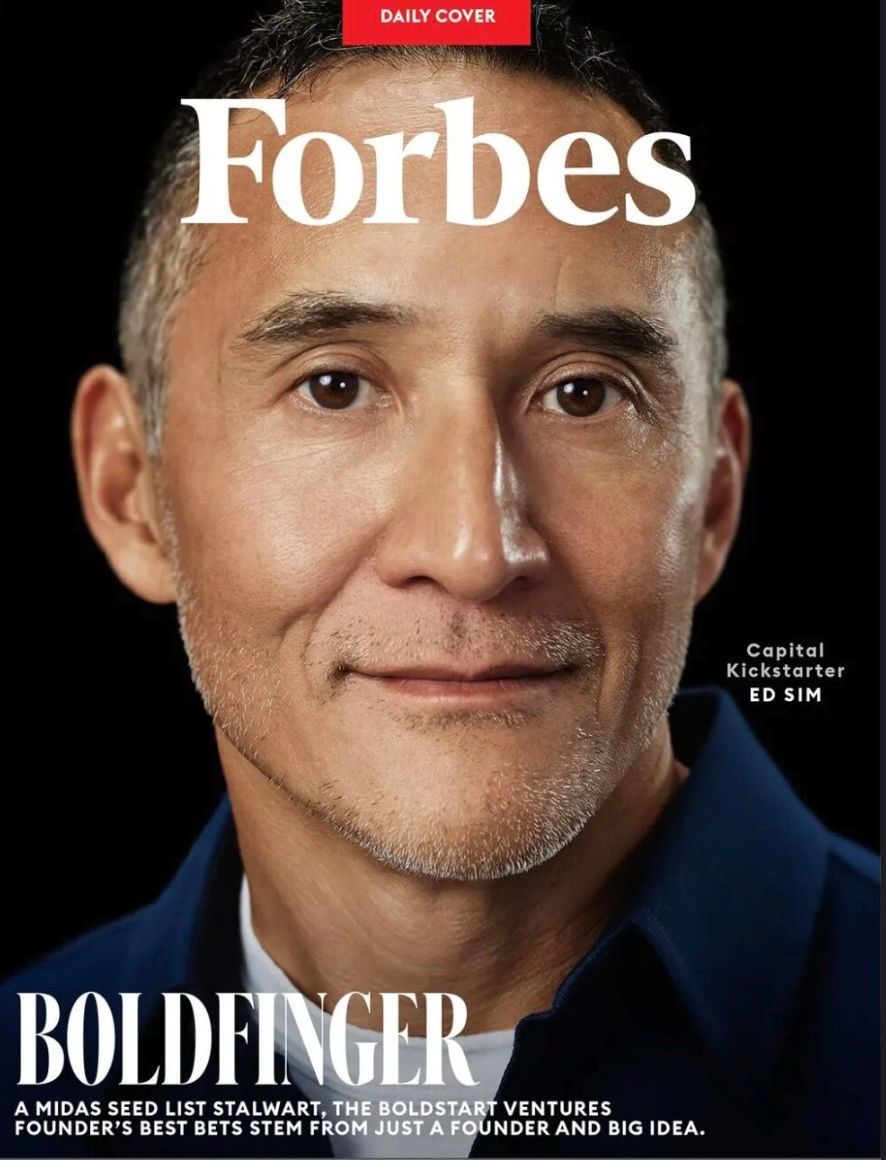

Forbes Cover Story on Ed for Midas Seed List 2024

Boldstart Ventures founder Ed Sim. GUERIN BLASK FOR FORBES

Jun 5, 2024,06:30am EDT

Updated Jun 5, 2024, 07:40am EDT

Few early-stage investors can rival Boldstart Ventures founder Ed Sim’s record at picking founders before they even have a business plan. It’s earned him a spot on the Midas Seed List for a third year.

By Iain Martin, Forbes Staff

In 2021, Ian Swanson took the mic at a Hawaii tech meetup to share a warning: The nascent boom in investment in artificial intelligence would start a new heightened game of cat and mouse between companies with valuable information and hackers looking to access it. The former AWS machine learning lead told the room of entrepreneurs and investors that cybersecurity teams would need new tools to keep villains from stealing and misusing data from AI-powered products.

His pitch was largely met with shrugs and mumbles. But for one person in the room, the idea resonated. Boldstart Ventures founder Ed Sim texted Swanson after he took his seat, and the pair stepped out on a hotel veranda to brainstorm business ideas. Five months later, Swanson had started ProtectAI with a $13.5 million seed round co-led by Boldstart. “I had nothing, but Ed said: ‘Let’s go start this company,’” Swanson told Forbes. The Seattle, Washington-based cybersecurity company went on to raise $35 million in a Series A round in December 2023.

Sim calls this “inception” investing: Writing a check to founders like Swanson, or Silicon Valley’s must-have email app Superhuman, before they have fully hashed out a business plan. “If you have a founder with a crazy vision that might be two or three years ahead of what’s available today, that’s when the magic happens,” Sim said.

The approach has put him in a rarefied group of top seed-stage investors and made him a fixture on Forbes’ Midas Seed list since its launch in 2022. Sim is the unusual seed investor to remain on the board of companies like cybersecurity unicorn Snyk, which was valued at $7.4 billion at its last raise in 2022, or BigId, which earned unicorn status with a $60 million raise in March, long after other early VCs would have been swapped out in favor of growth funds.

“It’s incredible how with all the giant funds around him he continues to be one of, if not the most valuable investors for us,” said Snyk founder Guy Podjarny.

Sim, who started writing early checks in 2010 long before the boom in seed funds, specialized in backing enterprise and infrastructure startups from New York when “Silicon Alley” was more of a digital desert. He left the city in 2022 for Miami, where he’s now become one of the few investors to have stuck around after the pandemic-era Techxodus ended. “By the time I left, New York had become a thing with every single West Coast VC moving in,” Sim said. “I felt like it was time for me to go because I don’t want to be in an echo chamber.”

Sim’s bid to break into venture capital had a few false starts. After studying economics at Harvard, he wrote letters to over 100 venture or private equity funds asking for a post-graduation job. “I got one letter back and they said, ‘Hey kid, get a job, move to New York and figure it out,’” he recalled.

He later found a role with JP Morgan’s derivatives desk and started coding to automate away his analyst duties. That’s when he discovered Marc Andreessen’s recently launched Mosaic browser. “I thought, holy crap, I need to get into venture capital now,” said Sim, who train-hopped to the now defunct Prospect Street Fund in 1996. “It reminds me of the AI world today in terms of how big the opportunities ahead of us are but also how much money we will lose in the next few years.”

In the very small world of late 1990s New York venture capital, Sim was introduced to Salomon Smith Barney vice chairman Bob Lessin, an angel investor. When Sim asked Lessin (father of Slow Ventures investor Sam Lessin) for a reference for his Harvard Business School application, the Wall Street heavyweight instead made him an offer. “Bob said, ‘I’m going to start a new venture fund, Dawntreader, and I want you to run it for me,’” Sim said. “If we fail you can always reapply to Harvard.”

Sim’s parents were disappointed by his plan to forgo an MBA. “My mom, being an immigrant parent, said, ‘Eddie, don’t do this job it’s too risky,’” said Sim, who grew up in Towson, Maryland, to parents who emigrated from South Korea.

Armed with Lessin’s rolodex and Wall Street backers, plus his own contacts, Sim started writing checks from Dawntreader’s first $20 million fund into companies like video conference startup GoToMeeting, chatbot provider LivePerson and Quora predecessor Answers.com. But peers and potential founders alike were baffled by the fund’s name and location, a reference to a C.S. Lewis’ Narnia novel. “Who’s Don? Who’s Treader? Why are you in New York?” said Sim, recalling the questions they faced. “I was like, guess what, I have these things called customers. Some of the biggest spenders on Wall Street are actually the most forward-thinking with IT budgets.

Those bets started paying off: GoToMeeting was later acquired by Citrix for $225 million, LivePerson IPOed in 2000 and Answers.com listed on the Nasdaq in 2005. Dawntreader’s second fund launched in 2000 and was more than 10 times the size of its original fund.

Then came 2001’s dotcom meltdown. “You know what happened? Kaboom!” said Sim, who continued investing through the fallout and also served several months as interim CEO of Dawntreader’s floundering portfolio company Moreover. “I have so many scars on my back from that experience.”

After it became clear that Dawntreader would not raise another fund, Sim left to launch Boldstart Ventures in 2010 with angel investor Eliot Durbin. “The idea was to be the most impactful small check for the founders that only need $1 million to nail it and scale it all,” Sim said. He was again met with skepticism for his New York base and focus on infrastructure and enterprise tech. “We did everything that we were told not to do by institutional investors,” he added.

The hangover from the 2008 financial crisis meant that Boldstart would begin with just a $1 million fund—but it now manages over $800 million of assets. Sim credits seeing his own parents’ determination, and spending a college summer selling Cutco knives door to door, for the drive that helped him grind through the lean years. “It took six or seven years of what I called ‘the annual no-call’ to get our first institutional investor,” he said, referring to his yearly attempts to call LPs, even when he thought he’d get turned down.

Founders typically see Sim’s own work ethic firsthand when they take a Boldstart check. “The guy hustles. He’s like the number one business development person for my company,” Swanson said. “He’s always bringing value.”

Much of Sim’s support is focused on the founder. “I probably talk to Ed everyday,” said Dimitri Sirota, founder of security and privacy platform BigId, where Sim sits on the board. “He’s got an emotional connection to the founders and I’ve always considered that he was there in our corner.”