Inception Investing: the new race to be first in Venture… and Pre-Seed isn’t first any more

It’s super competitive out there at earliest stages of venture. It seems like every VC is funding companies earlier and earlier to get pole position for the future.

Looking at the data, that used to be Pre-Seed, but frankly Pitchbook says the median age of companies funded at Pre-Seed is now 1.2 years old. That’s really not the beginning. In addition, Pre-Seed just doesn’t have the right connotation for a 3rd-time founder who can and will raise much more.

What’s needed is a new definition for what first is.

Let’s call these “Inception Rounds”.

Inception Investing means engaging with founders well before they incorporate, helping them battle test and iterate those ideas, helping them pre-sell some of the initial hires, and leading those rounds upon company formation so founders can run fast out of gates and not spend months trying to raise capital. It’s been happening for quite some time and is not constrained by any dollar amount.

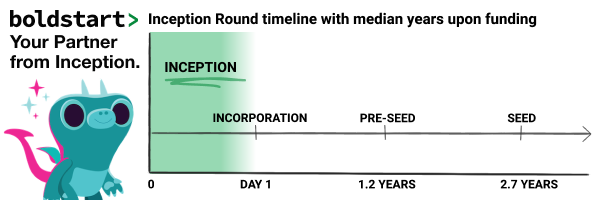

The timeline above shows where Inception Rounds really happen in green, and also the median age of companies upon raising rounds. This is not incubating, since that’s not scalable unless that is all you do. This is pre-accelerator since, well, you have to be incorporated to join, and this is pre-Pre-Seed.

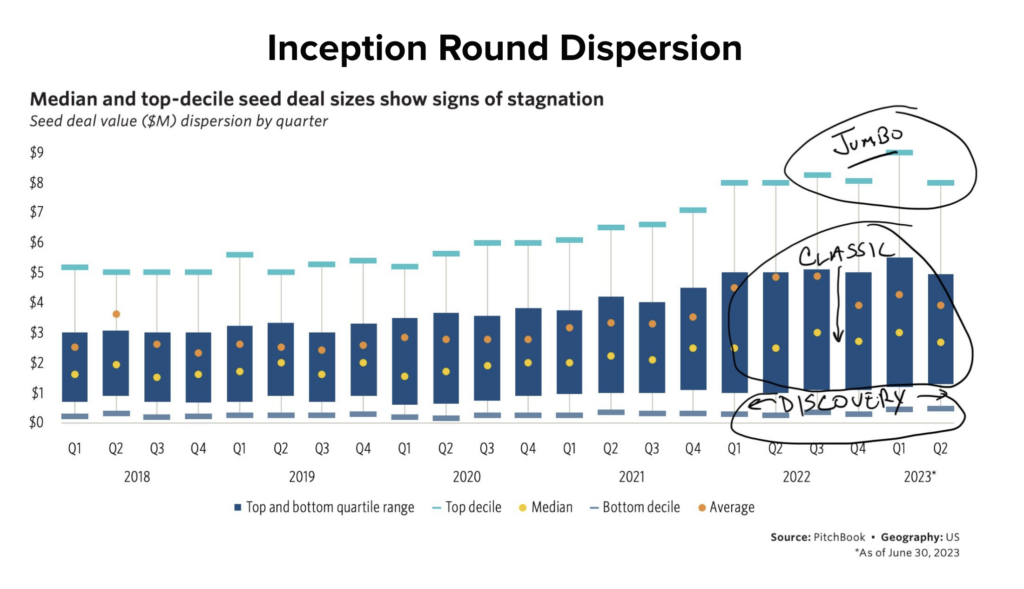

There are 3 kinds of Inception rounds I regularly see:

Discovery Rounds: <$2M

These are usually reserved for first-time founders who are exploring new sectors like WASM, who just need a bit of funding to hire their first few folks and iterate on some ideas. Discovery rounds typically graduate to a Classic or Jumbo round. This is the right size for a “Pre-Seed” fund, but it seems like many Pre-Seed firms still want a product before funding. Perhaps this is the byproduct of raising institutional capital?

Classic Rounds: $3–5M

A Classic round is generally for a first or second-time founder who usually can raise more but understands necessity is the mother of invention. They choose to be more constrained and lean to move faster, setting a lower bar for next round success. This is where most Seed firms play, but the median age for startups raising a Seed is 2.7 years — far from Inception stage.

Jumbo Rounds: >$6M

These rounds are almost always for a seasoned repeat founder with a prior exit, building their next company. Many times, it can be iteration #2 or #3 of the same idea, reinventing an existing market with a huge TAM. When multi-stage firms meet founders and markets like this, they are ready to SUPERSIZE the Classic round. This is also known as the classic multi-stage, Billion Dollar Fund round.

The race to be first

I ❤️ founders who prefer capital constraints, but sometimes you must also be able to do a few Jumbos for those special founders. This is the new race to be first — finding those special people, working with them well before incorporation, and arming them with capital to run fast.

Founders who are thinking about starting companies need one place to go to avoid all this confusion of going to a Pre-Seed fund, Seed fund, multi-stage or whatever. They need someone who can iterate with them, give them the confidence to incorporate, and know that when they become a legal entity they have the right amount of capital they need to succeed from the beginning. They will also need to partner with a fund with the right size who is big enough to lead any of these rounds, but also small enough that they get 1:1 attention — which means firms with concentrated portfolios.

This is happening across the board, especially as many $1B+ funds are creating programs to help founders start. But let’s face it — while it’s an amazing way for these firms to leverage brands built over decades, it’s really just a programmatic way to put option checks into lots of companies, and no great founder wants to be someone’s option.

For better or worse, the cat’s out of bag: look at the dispersion of round sizes as firms from Pre-Seed, Seed, and $1B+ compete and in world of multiple compression.

First is clearly the best place to be. This dispersion went from $300k-$5m in 2018 and almost doubled to $300k-$9M. This is not going back, and everyone must adapt!

If you’re a technical founder thinking about starting a developer first, enterprise infra, or SaaS co, please do reach out. Also check out our resources page and our Dev First Founder Toolkit for how to accelerate your path on day 1 (first day of incorporation) to PMF.