🧲 Product Market Fit (PMF) for Inception stage startups

This article was originally published on Medium.

Two weeks ago, boldstart partnered with Crew Capital to host a Founder’s Day, bringing together enterprise founders at different stages for a series of sessions on topics like pricing, how to time hiring for key roles, and zero to one marketing. I held a session on getting to product market fit (PMF), and thought I’d share some of the things that came out of that session.

What does “getting to PMF” actually look like?

The first question I posed to the group was “how will you know when you’ve reached product market fit”? The tricky thing about PMF is there’s no litmus test for whether it’s been reached or not. Instead, there are a bunch of different signals to look out for, with a combination of these helping indicate whether you’re on the right track.

Back in January, Lenny Ratchisky published a great article on how to know if you’ve got product market fit which I shamelessly mined for interesting talking points. He lists a whole spectrum of different signals to tune into. Some of these signals are lagging and take a while to become obvious, others require you to already be making revenue to be able to measure. Given that many of the founders we have in our portfolio are at the inception stage (so are pre-revenue) and are seeking quick validation, I narrowed the list down to these 3 signals:

- Growth: Are signups growing, or does growth look flat?

- Retention: Are users continuing to use the product after signing up?

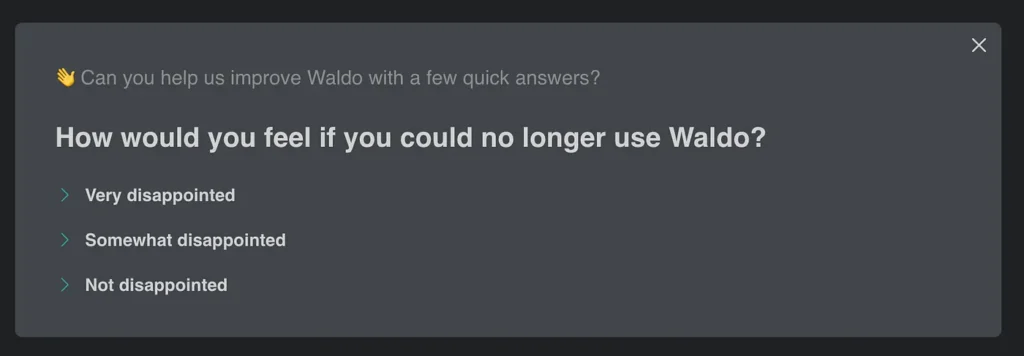

- Feedback: When asked, would 40%+ of users say they’d be very disappointed if they could no longer use the product? (AKA the Sean Ellis score).

A sticking point here is ensuring you’re reliably capturing these data points, and then that you know what good looks like — fortunately I’ve covered this in Product benchmarks for dev tools in 2023.

I really like the approach that Rahul Vohra of Superhuman (a boldstart inception investment) takes to not just determining but also optimising for PMF. He sent out a survey to his early users to determine that Sean Ellis score, as well as asking some additional questions including what type of people would most benefit from Superhuman. Initially, his score was 22%, but by focusing on the roles of users who were getting the most benefit already, and ensuring their needs were prioritised, he was able to grow that score to above the magic 40%. It’s worth reading his article as he goes into a lot of detail about his process to get there.

How big does that market need to be?

The second question I posed the group is how big a market they should be aiming for when thinking about PMF. A common mistake when trying to achieve fit is either that the market a founder is trying to appeal to is too broad to be able to satisfy enough needs to get traction (scattered feedback makes it hard to know what direction to focus on), or it’s too niche to be sustainable.

A strategy that I feel works well is to focus on a specific ICP (ideal customer profile), but with sightlines to expansion opportunities to adjacent users. That way, you can focus on solving very precise needs and really double down on those, and once you’ve proven the product works for those and a passionate user base, you can expand your focus to an adjacent market. That takes planning to ensure you have viable pathways into adjacent users.

To give an example, Snyk (where boldstart led the inception round) started out with a narrow market — it only supported the Node ecosystem so its ICP was Node developers using open source packages. Initially, it was hard to see the path there as it was having to compete against companies that supported a broad range of languages. What it aimed to do was be the very best solution for Node developers, prove the product worked, then expand to other languages. By being so focussed on one language, it had the side effect of gaining passionate users within those ecosystems, building up demand for the next ecosystem, and the next.

Here are some ideas on markets you could focus your ideal customer profile on:

- Technology: Focus on supporting a specific ecosystem or tool. One of the founders in the group mentioned he’d found success in aiming his product at customers of Linear, a complementary tool to his product, because users of Linear typically follow the same philosophies (agile, not comfortable with the status-quo, likely using a modern tech stack), that are compatible with his product’s approach.

- Role: Ensure your product is designed for a specific role within a company, such as a Customer Success Manager or a Site Reliability Engineer. Ensure you have a good range of people in this role to get regular feedback from.

- Business sector: Think about whether the pain your product is solving is felt more acutely in certain market segments, such as Finance or E-commerce.

Look at whose needs you’re meeting today, learn why, and double down on that. Find out who’s adjacent to them and tackle them. Then who’s adjacent to them, etc. Get these users prying the product out of your hands.

How do I know whether to stay on course, or try something new?

Another question I posed the group is how to know whether to double down or adjust course when trying to get PMF. This triggered a lot of discussion and apprehension.

Knowing whether to stick with the path you’re on in the hopes it’ll work out or try something different is an incredibly tough decision, and there’s no easy answer. You’ll need to determine whether it’s not working because the market isn’t there, or you’re too early (or too late). There’s a risk of switching course too quickly and often, but staying on a course that’s leading nowhere for too long can be death.

Consider whether you’re focussing on the wrong ICP. It’s pretty standard these days to ask a new user what their role is when they sign up to a product. This is either so they can customise the onboarding for that role, or so they can get an idea of who’s using it. Collecting this data can result in surprising learnings about who is actually getting value out of your product. And once you’ve settled on a viable ICP, figure out which of your users currently fit that profile and focus on them. If they can’t get excited about your product, it’ll be an uphill struggle to get users who don’t fit that exact profile excited about it.

PMF is not a silver bullet

Product Market Fit is often treated like a holy grail, and there’s a belief that attaining it will solve all problems. Think of it less like finally reaching the summit, and more like reaching base camp before attempting the peak — after all, once you feel like you’ve got PMF, you still need to turn that positive engagement into revenue and make it a viable business.

The thing that really stood out to me in this session was how much founders can learn from talking to each other. Every founder has to go through this same journey, and it’s very rare to get there without making some course corrections along the way.